- The future united bank number 1 in terms of assets will retain its locally renowned name UBB.

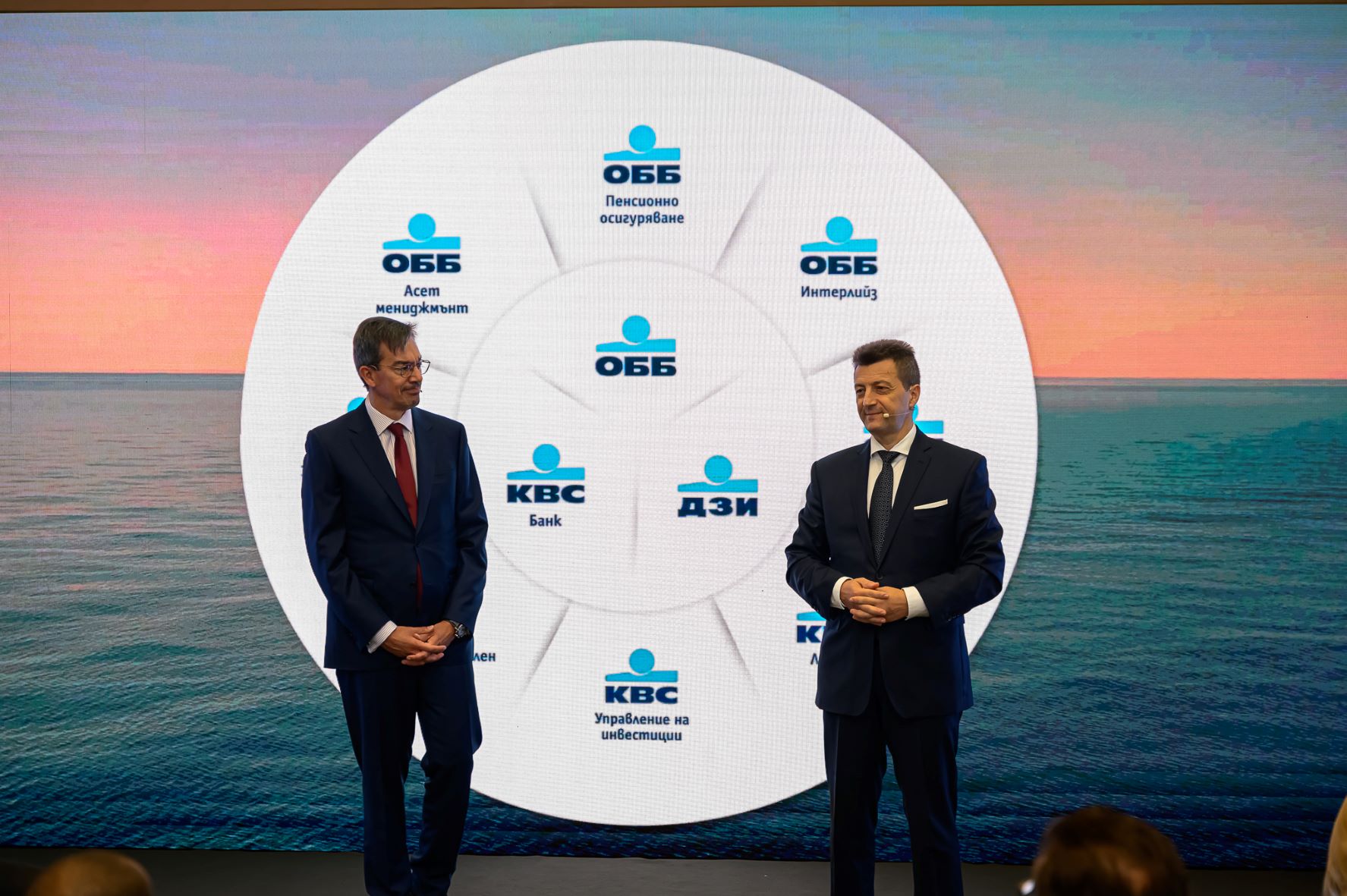

- The Belgian KBC Group becomes the largest integrated financial group in Bulgaria, servicing 2.5 million clients with its banking, insurance, leasing, brokerage, investment, pension assurance and factoring products and services.

- Peter Andronov is Chairman of the Supervisory Boards of KBC Bank Bulgaria and of UBB

- Peter Roebben becomes Chief Executive Officer of KBC Bank Bulgaria and of UBB

After the acquisition of Raiffeisenbank (Bulgaria) and its subsidiary companies in this country the activity of the Belgian financial group KBC in Bulgaria will encompass 14 companies in the banking, insurance, leasing, insurance intermediation, investments management, pension assurance and factoring domains, servicing nearly 2.5 million clients in Bulgaria.

The new companies in the Group will have in their names the internationally recognizable brand KBC. As of today the new name of Raiffeisenbank is KBC Bank. KBC Leasing is the new name of Raiffeisen Leasing, KBC Investment Management is the new name of Raiffeisen Asset Management, and KBC Insurance Broker is the new name of Raiffeisen Insurance Broker.

The newly acquired companies, bearing the name of KBC, are about to merge with the companies, bearing the name of UBB and performing identical activities – United Bulgarian Bank (UBB), UBB Interlease, UBB Asset Management and UBB Insurance Broker. Until their legal merger they will continue functioning as separate legal entities, as until then no substantial changes are envisaged with regard to clients.

According to an assessment of Fitch rating agency several days ago and as per recent data of the BNB as at the end of March 2022 the projected market share of the future united bank will be between 19 and 20% of the Bulgarian banking sector assets, as compared to approximately 12% to date, thus outrunning the first two market players until now in terms of assets. After the merger the new UBB will also rank first in terms of market share of deposits and second in terms of market share of loans. The Bank’s stability is being also affirmed by the rating of Fitch – UBB maintains the highest rating ‘А-‘ among banks in this country since 2017 onwards.

Today the members of the management of KBC Bank Bulgaria and its subsidiary companies have also been announced. Chairman of the Supervisory Board of KBC Bank is Mr. Peter Andronov, who is also Chairman of the Supervisory Board of UBB, as well as member of the Management Board of KBC Group and Chief Executive Officer of KBC International Markets.

The Chief Executive Officer of UBB, Mr. Peter Roebben also becomes Chief Executive Officer of KBC Bank Bulgaria. In the Management Board of KBC Bank remain all Bulgarian members of Raiffeisenbank Bulgaria's Management Board on their current positions and roles. Mr. Dobromir Dobrev continues holding the position Executive Director Corporate Banking and Capital Markets, Ms. Ani Angelova continues being Executive Director Retail Banking and Mr. Nedyalko Mihaylov remains in his current position – Executive Director Operations and Information Technologies.

Thus, the new Management Board of KBC Bank will comprise three of the executive directors of Raiffeisenbank Bulgaria until now and three of the present executive directors of UBB, as the two banks will start preparing for the merger.

As for UBB’s Management Board, Christof De Mil will manage the Integration Team. In his position of Executive Director “Finance”, he will be substituted by Teodor Marinov. Teodor Marinov keeps also his current position of Executive Director “Legacy and subsidiaries” in UBB.

There is no change in the management of the subsidiaries of the former Raiffeisenbank and the subsidiaries under the name UBB.

Mr. Oliver Roegl and Mr. Martin Pytlik will withdraw from the Management Board of the former Raiffeisenbank Bulgaria (now KBC Bank Bulgaria).

Until the merger of UBB and KBC Bank their Management Boards will work together, to ensure fast and effective integration upon full transparency and equal terms for both parties.

There is no change in the products and services, used by clients of the two banks. There is no need for clients to initiate additional actions in line with the change in the ownership and the name of the former Raiffeisenbank Bulgaria. Any eventual changes, affecting companies from the KBC Group in Bulgaria, will be communicated in due course to their clients. The merger of the companies from the Group will aim at offering clients higher quality and product diversity, more innovations and impeccable servicing.

About KBC Group in Bulgaria:

KBC Group is the biggest investor in the Bulgarian economy. Over the last 15 years of being in Bulgaria, KBC has invested EUR 2.4 billion in the acquisition and development of some of the most significant local companies and projects, among which the consecutive acquisition of DZI, CIBANK, UBB, the Bulgarian operations of NN and of Raiffeisenbank International. By means of a targeted policy for developing Bulgaria as their core market, both through acquisitions and in an organic way, the local bank of KBC has been constantly growing its market share, by rising from number 9 position in 2007 (CIBANK), going through number 3 position in 2017 (UBB and CIBANK) up to the forecasted number 1 position (after the forthcoming merger between UBB and KBC Bank). Under the management of KBC the company with the longest history in the insurance domain – DZI – has regained its leadership position on the market, by also climbing up in terms of market share from number 5 in 2007 up to number 1 to date. The leasing and asset management businesses of KBC Group in Bulgaria also occupy the leading positions.

In 2022 KBC Group in Bulgaria employs approximately 7000 people, servicing nearly 2.5 clients.